Business Overview

Kurita Water Industries, founded in 1949 and headquartered in Tokyo/ Japan, is a company that engages in various water treatment solutions.

It is organized in two divisions. Water treatment chemicals and water treatment facilities. The chemical segment offers water treatment chemicals for cooling-, waste- and boiling water, etc. The water treatment facility segment provides, among other things, pure and ultrapure water production systems, wastewater treatment and reclamation systems and maintenance service.

Kurita’s main customers are to be found in the electronic industry, which are dependent on its products and services in order to produce semiconductors, flat screens and other electronical components. But also the paper-, steel-, pharmaceutical- and petrochemical industry rely on Kuritas products and expertise.

The Worldwide Water Market

A research of Bank of America/ Merrill Lynch (Nahal et al.; 2012) shows, that there is no scarcity of water on the planet. The majority of its surface (roughly 70%) is covered by water. But freshwater represents only around 3% of the global water resources. Furthermore, the freshwater ecosystems are estimated to have declined roughly 40% since 1970 and wastewater reuse stands at only 2,4 % of all water withdrawals globally. This is less than the water used each day by US toilets at home.

In addition, the worldwide distribution of freshwater is extremely uneven. 10 countries are in possession of 60% of the worldwide fresh water resources. In 2012 46 countries were suffering from acute water stress and water scarcity.

Basically all sectors of the world economy are dependent on freshwater to a certain extent. Concerning the world water use it is to be observed that 70% is used by agriculture and 22% by the industry. But the distribution of the water use by those sectors fluctuate widely depending on the stage of economic development of individual countries.

In developing countries 82% of the freshwater is utilized by the agricultural sector and only 10% by the industry. Whereas in developed countries those proportions shift significantly. Here 60% of the freshwater is used by the industry and only 30% by the agricultural sector.

In developed countries the industrial water market already is a three-digit billion dollar market. Based on the accelerating trend worldwide of emerging countries stepping up its effort to industrialize their respective local economies, high growth rates in this market segment can be expected in the future.

Kurita Water Industries and the Industrial Water Market

In the segment of the industrial water market Kurita is extremely well positioned. Almost all companies engaged in the industrial water market have only a partial business interest in that segment. Kurita, on the other hand, is a “pure play”. It is solely engaged in this market segment. Only two other industrial water “pure plays” exist and are to be found in China (=Everbright) and Finland (=Kemira).

Although Kurita only has a market share of 25% in the Japanese chemical market for water treatment, the company’s market position in the ultra pure water segment for the semiconductor industry is unchallenged (70%). (Nahal et al.; 2012)

Based on the high differentiation of the water treatment technology high entry barriers exist, which gives the company a significant “moat”. Thus, the segment of industrial water treatment stands right at the top of value added chain in the worldwide water market.

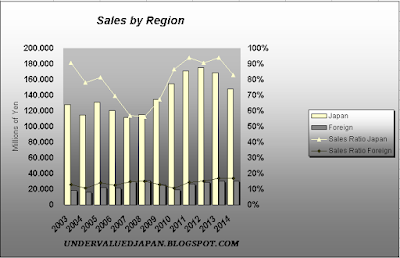

A drop of bitterness is the company’s limited presents internationally. The international business only contributes around 16% to overall sales. The slight increase recently is mainly attributable to the depressed level of sales within Japan.

The company’s management appears to be well aware of the significance of the international business going into the future. In the 2012 Annual report it communicated the TA-14 management plan (AR 2012).

It is a three-pillar strategy:

- Accelerate foreign expansion

- Increase market shares in Japan

- Development of new products and new business Areas

Especially the numerical targets on foreign expansions and overall growth appear to be overly ambitious and very likely will not be reached. This should be seen as the main reason why the company has been underperforming the broader Japanese equity market significantly.

Although Kurita will very likely not reach those numerical targets by 2015, concomitant factors and developments exist that give hope for a successful implementation of pillar one and three to a certain extent in the not too distant future:

- Change of the management framework. Formerly independent units in Southeast Asia are now supervised centrally. Not only does this allow the company to better serve their overseas customers and share resources, but also that the company reduces costs, as they now purchase raw materials centrally. (Nikkei March)

- Kurita is expanding its business for ballast water treatment for vessels. A market that is expected to grow significantly in the future (Nikkei July)

- Efforts by Kurita to cultivate the Chinese markets gaining traction. Lately two orders for facilities supplying ultrapure water, wastewater recovery, purification systems and wastewater treatment systems in mainland China was announced, totaling about 10 billion yen. (Nikkei June)

For a successful implementation of pillar one the Chinese market is the most promising and will be key for Kurita. Water is extremely scarce in China and the country has got a serious problem with water pollution. Especially the low tariffs on water led to little incentives for investments into water treatment in the past. (Nahal et al.; 2012)

According to Nahal et al. (2012) Chinese officials seem to be aware of those problems and taking countermeasures. Actions taken consist of:

- Investments by the state

- Deregulation and implementation of incentives for private investments

- Increase of tariffs on fresh water

General Valuation

Kurita’s stated P/E multiples and P/OCF multiples for the FY 2013 are 30 and 10. Especially a P/E multiple of 30 appears to be rich, even for a wonderful company. The same holds true for the average price multiples (27/15).

Those price metrics stand in stark contrast to EV/ EBITDA multiples. With an EV/EBITDA multiple of 7 for FY 2013 Kurita appears to be more than reasonably valued for such a high quality company. Reasons for the huge discrepancy between Price and EV multiples are to be found in high cash and investment balances on the balance sheet and conservative accounting policies followed by the company. In addition an EV/Sales Ratio of roughly 1 and EV/OCF Ratio of 7 point to a much cheaper overall valuation of the company than the price ratios reveal.

Although the following statement holds true for any reasonably serious security analyst, especially when valuing Japanese companies it is paramount to adjust stated numbers for conservative accounting, high cash/ investment balances, extraordinary and non-recurring items!

I do this with NOPAT (=Normalized operating profit after tax). For FY 2013 I come up with a NOPAT of 18.352 Millions of Yen. That leads to a P/NOPAT ratio of 14, significantly less than the stated P/E ratio of 30. EV/ NOPAT for FY 2013 is 9, slightly higher than the EV/Ebitda Ratio.

Analysis of Operations

Concerning sales turnover the facility business is Kurita’s most important business segment, representing roughly 70% of total sales. Historically the operating margins in the facility business were much more volatile than in the chemical business due to its cyclical nature.

Since 2009 overall sales are under pressure and margins are detoriating. Three contributing factors for this unfavorable trend stand out.

Firstly, the high yen exchange rate since 2008/2009 had a significant negative impact on the operations of the Japanese semiconductor industry, the main costumers of Kurita’s facility business.

The second reason is to be found in a strategic shift by Kuritas management in the ultrapure water supply business. Up to 2008 the electronic industry had bought the production systems and ran them on their own account. Customers were burdened with hiring and training knowledgeable staff and all the costs associated with operation, management and maintenance of those facilities. Customers wished to outsource this production stage. Kurita reacted to those wishes by its customers and in many instances Kurita now constructs and provides the complete operational management and maintenance of these systems at the customer site, while retaining ownership of these units on the customer’s behalf. Those customers simply purchase the ultrapure water supplied by these facilities and Kurita receives fees from customers based on the volume of water used on a monthly basis. It was a strategic shift away from selling facilities towards selling water. Due to the change in its business strategy huge capital expenditures were necessary, which led to high depreciation charges in the facility business segment. This has been dragging down operating performance metric in the facility segment significantly up to now. (AR2008)

Finally, Kurita could not successfully execute on its international expansion plan. Still only around 16% of its sales stem from international business, with Asia and Brazil being the most important oversea markets.

Given the abovementioned adverse circumstances Kurita is facing momentarily its operating margins and return metrics have to be regarded as decent. Especially the adjusted ones, which differ significantly to the stated metrics.

Adjusted average operating margins and return metrics differ only slightly to stated ones. Main reason is that only since 2009 accounting policy has been extremely conservative at Kurita.

The adjusted ROE for FY2013 of roughly 7% underperformes only marginally the stated ROE for Japanese companies listed on the Topix. With approx. 9% the adjusted 19- year average ROE reading is slightly higher than the actual.

ROIC (=Invested Capital/NOPAT) for FY 2013 stands at around 10%. Discrepancy between ROIC and adjusted ROE are caused by high cash and investment balances.

Quality of Earnings Analysis

“Earnings are an opinion cash is a fact.”

Kurita’s earnings are currently and over time amply backed by operating cash- flow. More importantly it is also backed by free cash- flow. Free cash- flow, and not earnings, is what a shareholder should be most concerned with. It determines the discretionary use of the companies generated resources available for maintenance and expansion of the business, as well as payout in form of dividends and/or share repurchase to its shareholders.

Kurita can be seen as a cash cow. In the last 16 Years Kurita did not have a single year with a negative OCF reading. In addition FCF (OCF-Capex) only saw three negative readings during that time span, mainly attributable to high capital expenditure. That high capital expenditure always was followed by a significant increase of its sustainable operating cash- flow readings in the following years.

To sum it up: Quality of earnings is extremely high in Kurita’s case.

Analysis of the Balance Sheet

At a current stock price of 2’390 Yen Kurita trades at a 30% premium to stated book value and a 13% premium to adjusted book value. Kurita’s balance sheet is pristine. The company does not carry any interest bearing debt on its balance sheet. In addition, most of its assets are current and liquid, with the majority of assets in cash and receivables and little in inventory.

Analysis of Pay-Out Policy

In the last 19 Years Kurita has constantly paid a dividend. The dividend guidance for FY 2014 is 46 Yen per share and leads to a dividend yield of roughly 2%. Furthermore, Kurita has been constantly raising its dividend per share year over year since 2005.

Kurita occasionally buys back its shares. The last buyback took place in the year 2012, where it bought back over 5% of shares out from its major shareholder Itochu.

With 28% for FY 2013 the adjusted total payout ratio (=dividends and share repurchase) lags the stated one (54%) significantly.

Given Kurita’s hidden earning power, huge cash generation ability, high cash and investment balances and its depressed stock price, it would be desirable that Kurita implements a more liberal share repurchase program.

Conclusion

Kurita Water Industries could be classified as a wonderful business at a cheap price.

It is one of the very few “pure plays” in the industrial water business, a market segment with substantial growth potential in the mid to long-term future. Due to high differentiation in its water treatment technology, high entry barriers exist that give the company a significant economic moat against existing and potential competitors.

In addition, due to high cash and financial investment balances, in combination with an extremely conservative accounting policy, stated financial operating metrics severely underestimate the “true” earning power of the company. Furthermore, the earning power is backed by substantial operating- and free cash- flow over time. Thus, quality of earning is extremely high.

A drop of bitterness is the company’s payout policy. Given the abovementioned factors, payout policy has to be regarded as inadequate.

Potential catalysts for a revaluation of the stock to the upside are manifold.

Firstly, a turnaround in the operations of the Japanese electronic industry, which is the main customer of Kurita’s products. In combination with a successful implementation of Kurita’s TA-14 management plan in the not too distant future, this could bring about a significant expansion of Kurita’s operating margins. The stock price could appreciate significantly without any expansion of price metrics and/or EV metrics.

Secondly, the market finally realizes the “true” earning power and franchise this company possesses and is willing to pay higher multiples.

Thirdly, due to the aforementioned strategic shift away from selling facilities towards selling water, Kurita made capital expenditures of around 110’000 Million Yen between 2006 and 2009. The accumulated depreciation charges between 2006 and 2013 (FY 2012) are 83`000 Millions of Yen. Basically, 75% of those investments had been written down by 2013. Should depreciation charges be lowered in the future, Kurita could show a significant expansion of its operating margins in the facilility business, even in the absence of any meaningful expansion of overall sales.

Finally, the management of the company admits to its overly conservative accounting and extremely strong balance sheet and is willing to return a larger share of future profits to its shareholders.

What could go wrong? Due to the rock solid balance sheet and historical operating performance of the company the “margin of safety” should be regarded as significant at Kurita. Nevertheless, the main risk that the investment thesis will not materialize would be the lack of successful implementation of the TA-14 management plan in the not too distant future. In combination with a persisting inefficiency of the overall Japanese stock market and an unwillingness of Kurita’s management to let shareholders adequately participate in future profits in form of dividends and/or share repurchases could lead to an ongoing underperformance of the stock against the overall Japanese stock market.

Source:

AR 2008

AR 2012

Sarbjit Nahal; Valerie Lucas-Neclin; A Blue Revolution - Global Water; Bank of America/ Merrill Lynch; ESG & Sustainability; November 2012

Nikkei March

Nikkei June

Nikkei July

Disclosure: Long Kurita Water Industries (JP:6370)

No comments:

Post a Comment