Company Overview

Kurita Water Industries Ltd. is one of the few pure water plays in the investment universe. It provides solutions in the field of water and environmental management, mainly in Asia. The company operates in two business segments. Water Treatment Chemicals and Water Treatment Facilities. The Water Treatment Chemicals segment offers boiler water treatment chemicals, cooling water treatment chemicals, wastewater treatment chemicals, process treatment chemicals, incinerator chemicals, equipment and systems for water treatment chemicals, and packaged water treatment management contracts. The Water Treatment Facilities segment provides ultrapure water production systems, wastewater treatment systems, and wastewater reclamation systems. This segment also offers ultrapure water supply, tool cleaning, soil remediation, chemical cleaning, and operation and maintenance services. It serves pulp and paper, steel, semiconductors, LCDs, oil refining and petrochemicals, pharmaceuticals, food and beverages, and real estate industries. The company was founded in 1949 and is headquartered in Tokyo, Japan.

|

| (click chart to enlarge) |

Analysis of Operations

Kurita has been constantly profitable for at least the last 15 years.

|

| (click chart to enlarge) |

In contrast to the asian crisis, which compressed Kurita's margins significantly, the latest crisis of 2008 had no material impact on its operating- and net-margin. Actual operating- and net-margins are 15,1% (8,5%) and higher than the 16 year averages (11,9% and 6,4% respectively).

|

| (click chart to enlarge) |

|

| (click chart to enlarge) |

Both business segments have seen operating margins expand. Average growth rate of operating income in the facility segment was 12,8% and outpaced that of the chemical segment (6%) significantly.

| ||

| (click chart to enlarge) |

ROE/ROA decreased slightly in the aftermath of the fincancial crisis 2008. This isn't attributable to compression in net-income (which was stagnant) but rather in an increase of total assets as well as shareholder equity (grew on average 5,9% p.a since 2008).

Actual ROE and ROA are 7,8% (6,1%) and slightly above the average readings (7,5% and 5,3%). Given that very little (financial) gearing is involved in generating these returns (equity ratio is 77%) those readings are more than satisfactory.

Average EPS growth (15 years) is 6,7%.

Analysis of Cash-flow

Operating cash-flow saw a huge boost from 2006 onwards. Average growth rate (11 years) was 18% p.a.

| ||

| (click chart to enlarge) |

Unfortunately, so did CAPEX. The significant increase in CAPEX depressed free cash-flow readings significantly. But Capex requirements has been seeing a huge reversal from 2009 onwards, sending the actual free cash-flow yield (at current share price) to formidable 9,2%. Average free cash-flow yield is more modest with 3,1%.

|

| (click chart to enlarge) |

Due to the reversion of Capex, depreciation charges in the future can be expected to decline in the coming years, with possible positive implications on net-income.

.png) |

| (click chart to enlarge) |

Analysis of Balance Sheet

Kurita has no interest bearing debt on its balance sheet. Little financial gearing is paramount for a company like Kurita, that operates in a capital intensive industry (==> high operational gearing). Highly leveraged companies in an capital intensive business are asking for trouble, should the business cycle turn downwards.

|

| (click chart to enlarge) |

Furthermore, I like how Kurita keeps total- as well as current liabilities in check. While total assets are expanding, expansion is solely financed internally.

|

| (click chart to enlarge) |

Kurita's liquidity position has always been favourable. But since the financial crisis of 2008 it has been getting even better. In my point of view, we are getting into territory which could be regarded as overcapitalized and optimization of its asset position should be considered.

.png) |

| (click chart to enlarge) |

Composition of its current assets is also favourable, with cash&short term investments as well as receivables being the biggest chunk. Inventory is a minor component.

|

| (click chart to enlarge) |

Cash & short term investments has been expanding swiftly, representing roughly 1/3 of Kurita's market cap.

|

| (click chart to enlarge) |

Longterm investments has been stablizing in recent years.

Overall book value, retained earnings and stock price is as follows.

|

| (click chart to enlarge) |

| ||

| (click chart to enlarge) |

On average (15 yrs.) book value increased 5% p.a.

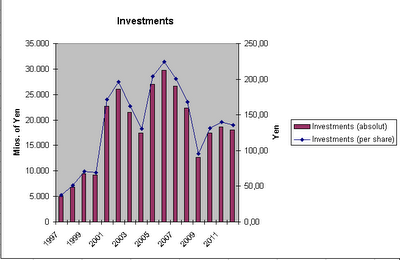

Analsis of Pay-out

Kuritas hasn't engaged as aggresively on share repurchases as other of my japan holdings.

|

| (click chart to enlarge) |

But valuation didn't warrant any aggressive stock repurchases (as the stock mostly traded at a significant premium over book value). When valuation warranted share repurchases (like 2003) management executed.

Given Kurita's current liquid position and valuation around book value, I'd like to see a more agressive approach by management in the near future.

| |

| (click chart to enlarge) |

Kurita has been increasing its dividend for eight consecutive years. The pay-out ratio is moderate (30%)

|

| (click chart to enlarge) |

Conclusion

Kurita Waters is an excellent business with a capable management, that alignes itself with the interest of its shareholders. In combination with current valuations, in my opinion, it makes a superb investment, hard to find outside of Japan.

I would like to see management to use share repurchases at current depressed valuation levels more aggressively, as optimizing asset composition becomes more pressing.

Disclosure: long Kurita Waters (JP:6370)

Good blog. I have been investing in Japanese stocks for. While. I think Mabuchi with it's shrinking revenues is a value trap and I won't touch it. Kurita is better but not as cheap. The problem with Kurita is that it is still 85% domestic and with Japanese manufacturing base destined to shrink, they have significant headwinds to growth. Kurita's management acknowledges this challenge. Overall, i prefer to invest in companies that are more export oriented and make a larger percent of their revenue base outside of Japan. I don't care as much about net net or not as long as the balance sheet is in good shape.

ReplyDeleteNice Call ;-)

ReplyDeleteOne Year + later Kurita turned out being (a supposed) value trap.

It is a very good company though. Just operating in a rather tough environment. They should buy back more shares at those levels. They've definetely got the resources.

Mabuchi too should buy back shares. They should have done so last year. Would have been a much more favourable level and they would have added shareholdervalue significantly. Not too late though.

ReplyDeleteI have gone through the site and read all blogs and this is a nice one:

Remediation and Reclamation

Thanks

Delete