For example, by only scratching a little bit the surface of Japan's so called "deflation malaise", at best Japan's "deflation funk" turns into price stability. (see here:http://undervaluedjapan.blogspot.de/2012/12/the-myth-of-japans-deflation.html).

Have we already gone so far that a central bank that is (really) pursuing price stability (and not just claming to do so) is labeled by the rest of the world as irresponsible? That such a (sustainable) monetary policy is pushing a country into a deflationary depression funk? If this is so than "Sayonara" to the rest of the world!

The other over and over preached misconcept about Japan's state of economic affairs touches on the sustainability of its government debt.

Most reports about Japan's public sector debt is accompanied by the dysphemism of Japan being "The land of the rising sum" or "The land of the setting sun". Than they come up with the shocking headline number of something around 230% of Debt/GDP that Japan has accumulated over time. Those headlines are catchy ballyhoo. They might sell papers or gives a narcistic vodoo economist his five second of fame. But they do not tell you anything about Japan's ability to service its debt in the future, e.g. the likelyhood of an argentinan style default.

For more on Japan's real debt situation see her: Japans-lost-decade-myth-my-own-take-on.html)

So what is the latest penchant of the japan bashing community? For sure; it is Japan's trade deficit!

Japan’s trade balance- Seeing red (Economist)

Japan's first trade deficit since 1980 raises debt doubts (Reuters)

Japan posts first annual trade deficit in 30 years (BBC)

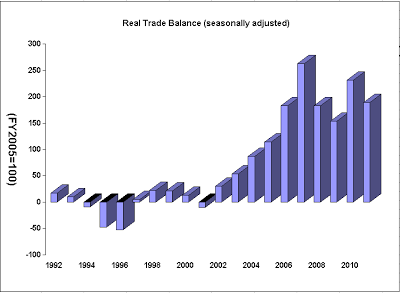

So that is what Japan's (nominal) trade deficit looks like graphically.

|

| (Source: BOJ) |

What does this number tells us if we took it at face value? Basically, imports of merchandise (at current prices!!) have exceeded Japan's export of merchandise. Furthermore, as the trade balance is a component of GNP it also dragged down Japan's level of GNP by roughly 40 trillion yen.

There are two main reasons for the nominal trade deficit.

Firstly, increased Gas and Oil imports (due to shut down of Japan's NPP after Fukushima) pushed Japan's nominal trade balance into a deficit. The result of that is that a part of Japan's GNP was basically transferred to oil exporting countries.

Secondly, the appreciating yen making japanese (export) products more expenesive.

That's the (well known) news out there. What those trade deficit headlines omit is, that when the trade balance is expressed in constant prices (==> real trade deficit) it turns out to be in a significant surplus. Thus, not eating into GNP in real terms but rather adding to it!!

And the real(ly) important numbers look like this:

|

| (Source:BOJ) |

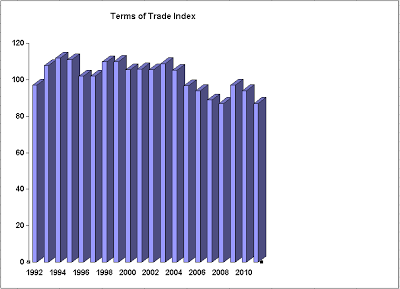

|

| (Source:BOJ) |

Isn't that miraculous? Exactly at the time when commodities started to see one of the biggest hausse in its history (2000/2001), Japan's real trade balance took- off to never seen highs and has been staying there up to now!

It looks to me that the whole world is suffering from the "serious money illusion syndrom". I only can come up with three possible explanations for that:

- Pundits are intelectually not capable to distinguish between relevant and irrelevant numbers (e.g. real vs nominal/gross)

- They are too lazy to do a little research and scrutinise the headline numbers

- They are misguiding the public opinion on purpose

No comments:

Post a Comment