Company and Business Overview

Ryoyo Electro Corporation engages in the distribution of semiconductors, computer systems and peripherals, and electronic devices mainly in Japan but also internationally. Therefore Ryoyo Electro is a classical trading company that is not engaged in the production of electronic devices. It was founded in 1961, is headquartered in Tokyo, Japan and the stock is listed on the First Section of the Tokyo Stock Exchange (TSE).

Many electronic trading companies exist in Japan. Ryoden and Ryosan are only two of numerous competitors. Thus, Ryoyo engages in a segment of the Japanese economy which is characterized by fierce competition and hence low operating margins.

General Valuation

Correction: EV and operational metrics in tables have been corrected to initial post. Reason: FY 2013 instead of FY2014 numbers were used for calculation. Mainly relevant for EV, which is not 6'080 Millions of Yen but 9'000!

Valuating the company solely under the spectra of price metrics Ryoyo

Electro does not appear very appealing. At a stock price of 1'490 Yen

the stock trades at an actual P/E multiple of lofty 22.

But as I have shown before, price metrics are a very flawed valuation tool when it comes to valuating a company, especially in Japan with its high cash balances and limited to non-existent leverage. For example in 2012, when the stock was first mentioned on this blog, the net- cash retained in the company has summed to 60% of its market capitalization.

Hefty investment portfolios, mainly accounted mark to market and composed of highly liquid assets, distort the price metrics further.

Finally, accounting policies in Japan are highly conservative. That usually distorts the denominator in the P/E ratio. In the case of Ryoyo this last factor is negligible, as Ryoyo is a Capex light company and accounting profits match economic profits most of the time.

Giving the aforementioned, the true investment case on a valuation basis only comes to light when the astute deep value investor adjusts for high cash balances, limited leverage and valuable investment portfolios and does value the company on an Enterprise Value (EV) basis.

Especially, the EV where Ryoyo's significant investment portfolio is excluded is with 9`013 Mios. of Yen still only a fraction of Ryoyo's market capitalization. This leaves us with an EV/Ebit multiple of 3,3 times. Still very cheap indeed.

Analysis of Operations

Ryoyo has not been able to isolate itself from the aforementioned harsh business environment, which is reflected in a decline in net sales and margin compression in the last several years. From 2003 till today sales at Ryoyo declined significantly. But since 2013 overall sales have fortunately picking up again.

Also operating margins, although still annoyingly low, seem to have bottomed in 2009/2010 and since then have been expanding slightly.

Return metrics also have been expanding again since 2009/2010.

As mentioned before average stated and adjusted EPS and return metrics do not diverge significantly for a Japanese company. Average stated EPS (=52 Yen) vs. the adjusted (=62 Yen) is roughly 20% lower. Alomst nothing for a Japanese stock! The difference is mainly attributable to extraordinary losses in 2001/2003/2007 and 2009.

Given the high cash balance ROIC is with 4% roughly double the ROE.

Cash- Flow

Operating cash-flow is extremely volatile. Ryoyo is debt free and finances its working capital needs internally. Build- up and cut backs in working capital therefore has a big impact in operating cash- flow metrics. Also cash- flow of investing activities is volatile, as Ryoyo tends to invest and divest a lot in long term assets.

Furthermore, it is in the working capital where the main operational risk to the company lies. Especially its financing of receivables may become in particularly harsh business conditions bad debts.

To sum it up. Ryoyo is an extremely low margin business. The likelihood of this to change is remote. Thus the investment case is not to be found in the company's operational situation or outlook! Among others, it is to be found in its strong balance sheet.

Analysis of the Balance Sheet

Although Ryoyo had been facing a harsh business environment, Ryoyo nevertheless was able to isolate shareholder's equity from a significant decline. This is mainly attributable to a quite impressive control of the company's cost base and the avoidance of (real) net losses.

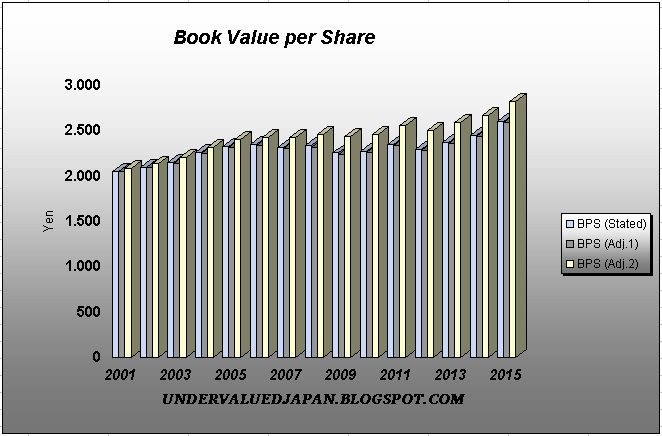

Ryoyo's equity ratio is 79% and stated Book value per share (BPS) stands at 2'600 yen, that leads us to a price to book ratio (P/B) of 0,6. Adjusted BPS is with 2'640 Yen only slightly higher than the stated one.

Much to my surprise in the last three years Ryoyo was able to increase

its BPS 3,3%, 3,3% and 6,1% in FY2012, FY2013 and FY2014. Especially the

increase in FY2014 of 6,1% compared to an increase of only 4% in net

assets shows the power of a clever share repurchase program at bargain

prices (see pay-out policy).

Ryoyo's book value is highly liquid. Although Ryoyo's cash balance has come down due to investment in working capital and share repurchases the balance sheet is still solid. But one has to note that compared to 2012, where the investment portfolio and cash represented the biggest chunk of the Assets, by now it is receivables!

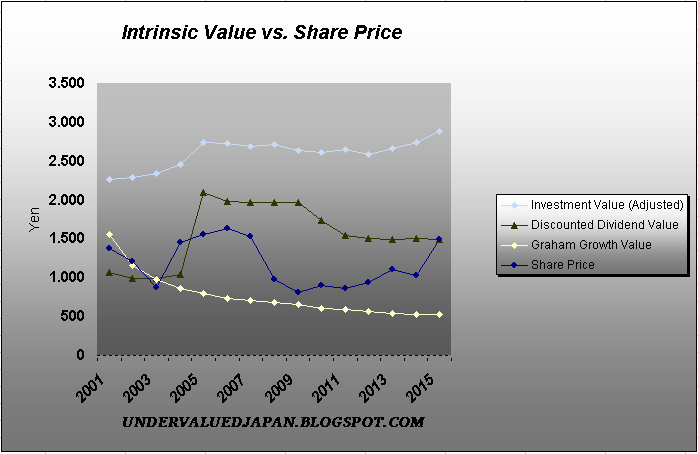

Still, liquidation value (investment portfolio included) stands at 1'744 Yen per share compared to the stock trading at 1'490 Yen. That represents a discount of roughly 15%. Thus, Ryoyo still is not only a J-Net, but rather a deep J-Net!

Net current asset value (NCAV), where the investment portfolio is included, stands at 2'490 Yen. Thus, Ryoyo still is trading at a huge discount to NCAV.

Analysis of the Pay- Out Policy

Ryoyo has constantly been paying a dividend. Currently it is paying 30 Yen per share, which is giving us a dividend yield of 2% at the current stock price. Given the low interest rate environment in Japan and worldwide this is more than decent.

Pay-out ratio for FY2014 was 45%. Given the limited growth prospect of the company high pay-out ratios are warranted.

But dividends are not the only means that the management uses to let the shareholders of the company participate in the profits.

The company has been engaging in significant repurchases of its shares.

Shares most of the time are purchased at bargain prices.

Right now the company is repurchasing more than 2% of its outstanding shares on the open market.

It is offering 1'600 Yen per share. Although the management is only offering a fraction of the intrinsic value of the stock, "investors" willingly giving away its shares at 1'500 Yen. What is riding those "investors" is beyond me, but not the first time I come to observe such disturbing behavior in this stock on the shareholder side.

Anyways, Ryoyo implements a repurchase program in a flexible manner. The result is an overall payout- ratio of up to 250%. Contrarily to many "investors" in this stock, management appears to be well aware of the stock trading at a huge discount to intrinsic value.

By paying out so much of net income, Ryoyo's management is basically partially liquidating the business. By doing so it makes the process of (at least partial) value realization in a reasonable time frame for the deep value investor so much easier.

Intrinsic Value

Following are some graphs concerning Ryoyo´s intrinsic value other than Liquidation Value and NCAV.

Ownership Structure

The largest shareholder of Ryoyo is Simplex Asset Management. It is an "activist" from within Japan. It usually is a long-term investor and mostly engages in a cooperative approach to shareholder activism, advising the management mostly concerning matters of capital efficiency.

Interesting would be to know who the Shimada Yoshisa Family is. Unfortunately I have no clue.

Conclusion

The investment case for Ryoyo is not to be found in its operational metrics. It is to be found in the balance sheet, the liberal pay- out policy by the management and ownership structure.

The main downside risk in the stock is to be found in its financing of receivables. If business conditions start to deteriorate significantly those receivable could become bad debts.

J-net investing gained some popularity on the blogosphere in 2011/2012. One does not hear a lot of those who invested in J-nets lately. That let me assume that the strategy must have disappointed the proponents. If this is so I am sure that those investors did not discriminate enough when choosing J-nets. Especially neglecting the shareholder structure is not a good idea as I showed here. Furthermore, the management being or not being aware of the stock being severely undervalued and trying to remedy such an undervaluation is extremely important. It facilitates the value realization in a net-net stock enormously. Those investors who neglect such factors are basically fighting city hall. Something I personally not very keen on at this stage of my investment career!

Disclaimer: Long Ryoyo Electro

Hi,

ReplyDeleteExcellent post.I am long Ryoyo Electro at cost of 1012 yen. I started J net investing in mid 2013. So far so good.

thanks

Adib

"Net current asset value (NCAV), where the investment portfolio is included, stands at 2'490 Yen. Thus, Ryoyo still is trading at a huge discount to NCAV.

ReplyDeleteGreat article. How did you come up with NCAV of that value though? Isn't it only around 1700yen?

Thanks.

Delete"How did you come up with NCAV of that value though?"

I analyzed the balance sheet.

" Isn't it only around 1700yen?"

2'500 yen is the magic number! The investmentportfolio is (mostly) composed of marketable and liquid assets.

As far as I can see it the biggest position is in Mitsubichi electric with roughly 2,5 million Shares.

For all my j-nets, I have been looking at the balance sheets, taking the Total Current Assets and subtracting the Total Liabilities from that. Then I divide the difference by the total outstanding shares to arrive at the NCAV.

ReplyDeleteFor example, for Ryoyo, it's Jan 2015 numbers are:

TOTAL CURRENT ASSETS = 65,177 mil

TOTAL LIABILITIES = 17,355 mil

Difference = 47,822 mil

Divide by 28.2 mil outstanding shares = NCAV = 1695 yen per share

Would you be able to elaborate on your formula?

You mention marketable investments, etc. Are you adding the Long-Term Investments of 16,917 mil into the TOTAL CURRENT ASSETS number?

If so, the NCAV would alternatively be (65,177 + 16,917 - 17,355) / 28.2 = 2295 yen per share, which is still short of your 2490 yen value.

Well. The numbers you claim might be wrong.I come up with even lower figure for longterm investments than 16'917 million. It might be closer to 15`000 milliion. Why do you bother about 10 % +/- so much? There is no magic formula in value investing!

Delete"Divide by 28.2 mil outstanding shares"

DeleteWhere do you get your numbers from? You have to be careful with MSN or businessweek!

I come up with roughly 25 Mio. shares out. I substracted the treasury shares.

Hello,

DeleteYou're right. I've been using BusinessWeek's (now called Bloomberg Business) numbers.

Do you suggest going directly to the financial statements filed with the Japanese stock exchange for better accuracy?

You can find what I've been using here: http://www.bloomberg.com/research/stocks/financials/financials.asp?ticker=8068:JP&dataset=balanceSheet&period=A¤cy=native

For treasury shares, maybe I don't quite understand, but are you taking the outstanding shares of 28.2 mil (as shown in Bloomberg Business), and subtracting the treasury stock value of 3,270.0 (as shown in the 2015 numbers)?

Do you suggest going directly to the financial statements filed with the Japanese stock exchange for better accuracy?"

DeleteYes! That is indispensable. I use bloomberg business, too. But more like a hand screen. If I like what I see Igo to their internetpage. If the company has no english IR page I let it go. Regardless of how cheap the company is.

"For treasury shares, maybe I don't quite understand, but are you taking the outstanding shares of 28.2 mil (as shown in Bloomberg Business), and subtracting the treasury stock value of 3,270.0 (as shown in the 2015 numbers)?"

Exactly. Especially if the company has a history of retiring those shares over time like Ryoyo does.

For your sell target, do you use the NCAV (including LT investments) ? or hold even past NCAV.

ReplyDeleteI am not sure yet. A lot has been chaging for the better at this company. Earning power is slightly increasing. Management is very sharholder friendly. All the share buybacks at those insanely low prices are going to add back nicely to the future intrinsic value and earning power.

Delete