Company overview

Yodogawa Steel Works, Ltd. is an independent Japanese

steelmaker located in Osaka. It mainly provides surface treated steel sheet. It

is particularly strong in color steel sheet.

The Company operates in four business segments. The Steel

Sheets-related segment manufactures and sells coated steel sheets, galvanized

steel sheets and cold-rolled steel products. The Roll segment is engaged in the

manufacture and sale of steel rolls, non-ferrous rolls, etc. The grating

segment is engaged in the manufacture and sale of gratings. The Real Estate

segment is engaged in the leasing and sale of real estate.

Most of its products are provided to corporate customers,

such as building contractors and consumer electronics maker, but the company

also handles household use storerooms, carports, and photovoltaic power

generation, among other things, for general consumers.

It runs plants in Osaka, Kure, Ichikawa, Fukai and Izumiotsu. It started steel sheet sales through own sales offices. It also has a large overseas plant in Taiwan. The joint venture subsidiary, which operates the Taiwanese plant, is listed on the Taiwan Stock exchange. The company also set up local firms in Taiwan and China to produce and sell surface treated steel sheet.

General Valuation

Apart from price metrics in relation to book value and sales, Yodogawa does not appear being a deep value investment.

EPS for FY ended March 2020 came in at 132 Yen leading to an

actual P/E ratio of 15.

Average EPS for the last 21 Years was 96 Yen leading to an

average P/E ratio of 20.

The P/E ratios do not appear really compelling for such a

low margin business like Yodogawa. But P/E ratios in general are very flawed metrics.

Especially in corporate Japan with its high cash balances, big investment

portfolios and low financial gearing.

To adjust for the overly conservative financing of the

company EV/ Ebit and EV/ Ebitda ratios are used. The enterprise value (EV) of

the company stands at 15’070 Mios. of Yen. If Yodogawa’s investment portfolio

is excluded, which consists of highly liquid assets, which are marked to

market, the EV turns highly negative (- 19’ 700 Mios. Of Yen).

An Ebit of 4'360 Mios. of Yen and Ebitda of 8’148 Mios. of

Yen the EV/Ebit and EV/ Ebitda ratio (incl. Investments) is only 3,5 and 1,9

respectively.

Overview of Operations

Sales suffered significantly during the great financial

crisis (GFC) and have never recovered to pre- crisis levels. Stated operating

margins and net income margins have been low and volatile for a long time. For

the FY ended March 2020 a meager 3.5% and 2.5% were reported.

Stated return metrics and EPS are highly volatile, and the company reported three loss years in the last 21 Years. Stated ROE and ROA for the latest FY came in at a poor 2% and have been poor historically.

Interesting to note is the fact that the company is showing

quite significant aberration between stated and adjusted operating and return

metrics, which are brought forth by extremely conservative accounting

procedures. In addition, adjusted return metrics are significantly less

volatile.

Analysis of Cash Flow

Not only with its stated vs. adjusted margins Yodogawa

exhibiting discrepancies, but more importantly so in relation of earnings to

generated operating and free cash flow.

At a current market price of 1’930 Yen and stated average

earnings per share of 96 yen for the last 21 years, the stock is trading at an

average P/E ratio of 20. Whereas the average P/OCF ratio stands at only 7. Furthermore,

FCF generation appears much more stable than the volatility of stated

operating, earning and return metrics would suggest.

In addition, although average stated ROE is only around 2%, the average FCF yield is almost four times higher (roughly 8%).

Interim Conclusion: A well-established Japanese steel

company that has been showing low operational and return metrics over an

extended period. By scrutinizing stated metrics, discrepancies emerge. It

appears that the company is misrepresenting its operational efficiency for the

worse and underreporting its true earning power.

Analysis of Balance Sheet

Yodogawa does not carry any interest-bearing debt on its balance sheet, which is astounding. I think I have never come across a steel manufacturer that has no financial leverage at all.

Stated overall book value per share has been increasing moderately by approximately 3% p.a. The equity ratio for FY 2020 stands at a staggering 83%. The decrease around the GFC is attributable to losses on valuation of investment securities and impairment on PP&E.

Cash and investment holdings have increased significantly since the GFC, but lately expansion has stalled.

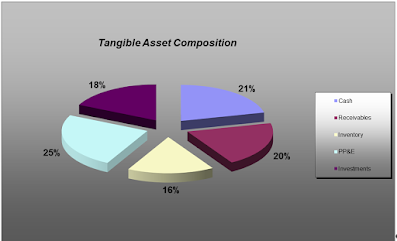

Asset composition has been seeing a significant transformation over time, away from fixed assets towards more liquid assets. As for the latest FY asset composition is highly favorable. Cash, receivables, and the investment portfolio make up for roughly 60% of total assets. Goodwill and intangibles are negligible.

Yodogawa’s investment portfolio is highly valuable and mainly composed of the biggest two coating manufactures within Japan. Other relevant holdings are a well-established Japanese building material company and an elevator manufacturer.

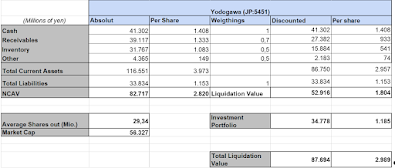

Yodogawa’s NCAV is roughly 2’800 Yen per share. At a share price of 1’900 Yen the stock is trading at a discount of roughly 33%. If the highly valuable investment portfolio were included (1’185 Yen per share) the discount would widen significantly to 52 % per share.

The stock is even trading at a discount to liquidation value

(incl. Investments), which is quite remarkable for a dividend paying and cash

generative business. The discount to liquidation value is roughly 37%.

Thus, according to the Graham and Dodd philosophy the

minimum upside potential should be the liquidation value including investment

portfolio (approx. 60%). Maximum upside should be the NCAV incl. investment

portfolio (roughly 110%).

The trend of NCAV is favorable.

The same holds true for the liquidation value.

Yodogawa’s PP&E account is quite remarkable, as it

contains significant hidden assets. It contains a golf course, warehouses, a

guest house and several other buildings and land, mainly located in the Hyogo prefecture.

Till 2017 the difference between carrying value and fair value of the real

estate portfolio was published and showed a significant amount of hidden asset

value.

The crown jewel in Yodoko’s property portfolio is the Yodoko Guest house, which was designed by the fabulous and renowned star architect Frank Lloyd Wright. It is the only still existing Wright building in Japan and has been designated as an important cultural property by the Japanese government. Valuing it as priceless is no exaggeration.

Interim Conclusion:

Debt- free Company with a severely overcapitalized balance

sheet. Overall business is cash generative and adjusted EV in unchartered

negative territory. Company is hiding true earning power through extremely

conservative accounting policy. Fair value of the real estate portfolio is

significantly higher than the carrying value on the balance sheet.

Analysis

of Shareholder Returns

For FY 2020 the company paid a dividend of 70 Yen per share.

At current market price the dividend yield is 3,7 %. The interim dividend for

FY 2021 was 35 Yen. Due to Covid 19 a

year end dividend has not been declared so far. The stated average payout ratio

over the last 21 years was 44%. The real ratio was 27%, significantly lower.

The company is engaged in share repurchases on a continuous

basis. The company has been buying back shares in 17 out of 21 years. The share

count over time has decreased by roughly 30%.

Share buy backs were executed at extremely value accretive terms for the remaining shareholders. All of them were executed below stated book value and the majority even below NCAV and liquidation value.

Corporate Governance

The fundamental analysis of the company conducted so far,

begs the question what makes Mr. Market valuing the company as if it is heading

for bankruptcy. The fundamentals presented in this post do not indicate any

distress the company might be facing. Quite to the contrary. It reveals a

company that is delivering decent adjusted owners’ earnings, has a vast amount

of net liquid assets and a severely understated PP&E account.

The only sensible explanation for Yodogawa’s extreme undervaluation

is Mr. Market applying a massive corporate governance discount to this company.

But is he rightly doing so?

As far as I know the company has never been approached by any

activist fund and the current shareholder register does not indicate any

activist involvement momentarily.

Although, the company has been having a take-over defense

mechanism implemented, I personally see it as a plus. An abolition would result

in immediate corporate activism with the danger of shareholder been taken out

at unfavorable terms. Should the share price recover to a fair value basis abolition

should be on the agenda at coming AGM’s.

Apparently, management does not act against the best

interest to shareholders in hostile manner like it was the case with Kawasumi

(see shareholder return policy). But a more aggressive approach regarding

matters concerning capital efficiency and a renunciation of extremely

conservative accounting policies is urgent.

Given the severe overcapitalization of the balance sheet, the best measure management could take to mend the severe undervaluation in a timely manner is adopting a shareholder return policy based on dividend on equity (DOE). Basically, paying out a certain rate on equity.

Conclusion

Yodogawa is an ok business, that is misrepresenting its

operational performance for the worse and hiding assets over an extended period.

Why it is doing so remains a mystery!

For a long time, the company has had a balance sheet that has

been overcapitalized. A valuation only based on the net liquid position

indicates a hugely undervalued security. If hidden assets are included in the

analysis the undervaluation becomes insane, seldom seen in my career as a

security analyst.

On an asset basis the company has been undervalued for a long

time, but the discount between intrinsic value and the market price has been

steepening significantly in the last 3 years.

The main culprit for this steep undervaluation is not to be

found in extremely poor decisions concerning capital allocation by management, but

rather in total ignorance of market participants within Japan and abroad.

Due to the existence of a poison pill a certain corporate

governance discount is warranted. But at Yodogawa Steel Works this discount is hilarious.

Disclaimer: Long Yodogawa Steelworks

On the website "https://www.kenkyoinvesting.com", there's a post from January 2020 saying Yodogawa engaged in some questionable practices:

ReplyDelete"Yodogawa Steel Works (TSE: 5451) is an independent steel maker manufacturing and selling steel sheets, building materials, rolls, and gratings as well as offering plant engineering services.While the company has remained consistently profitable at the operating level, there are some red flags like price-fixing and data falsification which raises concerns over Yodogawa’s competitive […]"

I don't have the paid account for the site but would be interesting if you had read this or had any ideas on the topics. Thanks for a great blog.

Regards, Arne Ottelin

Hi Arne,

DeleteI didn't read the report, but asked clayton about it.

The red flags were referencing to price fixings in FY03 and quality data falsification in the roll business (think was fy17).

Best

Otto

Thanks for the post. Could you please explain more about the take over defense mechanism?

ReplyDeleteWelcome.

DeleteBasically, they would dillute the shareholdings of the activist by issuing shares/ warrants to all the shareholders. The activist would not get any.

Hope that helped.

Great post O-Tone. Very interesting once you get to the balance sheet analysis.

ReplyDeleteIt looks like approximately 20% of assets and 18.5% of revenue are in Taiwan. Rightly or wrongly I view these as more risky due to the geopolitical risk of China one day invading. Even completely discounting these you still have a healthy margin of safety.

I have taken a small position and looking forward to digging a bit deeper.

Weak Yen at the moment definitely making Japanese stocks attractive. I am extremely interested to see how things shake out with the exchange rate and the high levels of debt going forward. The answer is probably obvious but I am too dumb to see it.

Thanks

Ryan

Thanks! Make sure to let me know when you dig up something interesting!

Delete