Fukuda Denshi is a leading Japanese medical device manufacturer. It offers a wide range of medical equipment products like, among others, defibrillators, patient monitoring, vascular screening -, ultrasound -, stress test - and respiratory systems. In addition, the company provides therapeutic instruments for sleep apnea syndrome and sells AED (automated external defibrillators).

Lately, the company has successfully expanded into the rental medical equipment for home care, including oxygen concentrator devices, which is starting to contribute significantly to the bottom line.

The Company holds high market share within Japan in several business segments that show significant growth, a duopolistic/ oligopolistic market structure and a secular tailwind due to the aging population.

The absence of promotional behavior (limited IR), low trading volume of the stock and no analyst coverage has created a stupendous value dislocation in absolute and relative terms seldom seen in my career as a security analyst and investor.

Basically, the company is a long- term compounder, trading at double liquidation value, spitting out an incredible amount of (growing) free cash- flow while investing significantly in future growth that is totally lacking attention of the Buffett style investors.

Overview of Operations

Over a time- frame of 18 years Fukuda Denshi was able to grow its turnover by roughly 4 % p.a.

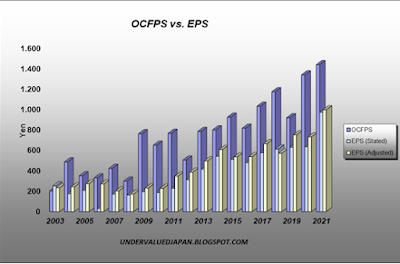

At the same time adjusted earning per share (EPS) has increased roughly 8 % p.a. and operating cash- flow per share (OCFPS) roughly 12% p.a. Since the start of Abenomics end of 2012 the growth rate is roughly 11% p.a. and 13% for both metrics.

Free Cash- flow per share (FCFPS) generation is Fukuda Denshi’s strong suit. FCFPS increased at an astounding rate of 16 % p.a. over a period of 18 years. Since Abenomics it slowed to roughly 13%.

Especially, against the background that Fukuda Denshi has been constantly increasing investment in growth capex, which is not even considered in this FCF examination. In addition, it explains the subdued growth since the start of Abenomics.

General Valuation

General Valuation

Fukuda Denshi current stock price is 8'700 Yen.

Adjusted ROE for 2020 is roughly 11%. Return of invested capital (ROIC), basically the ROE metric adjusted for Fukuda’s high cash balance (Net Cash roughly 22% of Market cap), is with 19,5% significantly higher.

Liquidation value (incl. Investments) stands around 4’500 Yen per share.

For a Japanese company ROE, and especially ROIC, has to be regarded as high. At a stock price of 8’700 Yen an investor only pays 9 times earnings, 0.9 of book value and an incredible two times liquidation value.

But it gets even better, as price metrics are a very flawed metric, especially in Japan with its high net cash balances. The concept of enterprise value (EV), earnings before interest and taxes (Ebit) and earnings before interest, taxes, depreciation and amortization (Ebitda) adjusts for those flaws found in pure price metrics.

Excluding Fukuda’s investment portfolio, the stock is trading at extremely depressed EV/ EBIT and EV/ Ebitda ratios of 2,5 and 1,8.

Relative Valuation

Fukuda Denshi’s main competitor on the Japanese market is the company Nihon Kohden. Thus, it lends itself to perform a comparative analysis of these two companies.

Already when comparing the stated price metrics and operating margins of those two companies, the value discrepancy becomes apparent. Although exhibiting almost the same operational efficiency, Fukuda Denshi is trading at a significant discount to Nihon in relation to book value and P/E Ratio. In addition, does Fukuda Denshi offer a significant better dividend and FCF yield.

But how steep Fukuda Denshi’s relative discount really is becomes only apparent with a comparative analysis on EV basis.

Whatever EV ratio you take into account, they all show that Fukuda Denshi trades only at a fraction of Nihon Kohden. And this for the company that has the higher ROIC and FCF yield!

In addition, when taking Fukuda Denshi’s significant investment portfolio into account the valuation discrepancy of those two companies become outright obscene.

Conclusion

Fukuda Denshi is a growth stock and compounder engaged in an attractive segment of the Japanese economy that has a structural tailwind due to demographics. The company does not show supercharged sales growth, but growth is highly profitable in terms of EPS and more importantly FCFPS.

Fukuda’s valuation is severely depressed in absolute and relative terms. The severe undervaluation only becomes apparent when the market cap is adjusted for the high balance of liquid assets and absence of financial leverage, i.e. a valuation on enterprise value basis is conducted.

Fukuda Denshi’s main competitor is Nihon Kohden. At current market price Fukuda Denshi trades at a fraction of Nihon Kohden’s multiples. At the same time Fukuda Denshi’s operational efficiency and dividend yield is higher, it has been investing more in future growth and growth is more valuable.

Disclaimer: Long Fukuda Denshi

Relative Valuation

Fukuda Denshi’s main competitor on the Japanese market is the company Nihon Kohden. Thus, it lends itself to perform a comparative analysis of these two companies.

Already when comparing the stated price metrics and operating margins of those two companies, the value discrepancy becomes apparent. Although exhibiting almost the same operational efficiency, Fukuda Denshi is trading at a significant discount to Nihon in relation to book value and P/E Ratio. In addition, does Fukuda Denshi offer a significant better dividend and FCF yield.

But how steep Fukuda Denshi’s relative discount really is becomes only apparent with a comparative analysis on EV basis.

Whatever EV ratio you take into account, they all show that Fukuda Denshi trades only at a fraction of Nihon Kohden. And this for the company that has the higher ROIC and FCF yield!

In addition, when taking Fukuda Denshi’s significant investment portfolio into account the valuation discrepancy of those two companies become outright obscene.

Conclusion

Fukuda Denshi is a growth stock and compounder engaged in an attractive segment of the Japanese economy that has a structural tailwind due to demographics. The company does not show supercharged sales growth, but growth is highly profitable in terms of EPS and more importantly FCFPS.

Fukuda’s valuation is severely depressed in absolute and relative terms. The severe undervaluation only becomes apparent when the market cap is adjusted for the high balance of liquid assets and absence of financial leverage, i.e. a valuation on enterprise value basis is conducted.

Fukuda Denshi’s main competitor is Nihon Kohden. At current market price Fukuda Denshi trades at a fraction of Nihon Kohden’s multiples. At the same time Fukuda Denshi’s operational efficiency and dividend yield is higher, it has been investing more in future growth and growth is more valuable.

Disclaimer: Long Fukuda Denshi

Nice! Great to see a company being covered from 2012 till now. Shows the value of long term investing.

ReplyDeleteGreat write ups, thanks for sharing this (and the prior 2).

ReplyDeleteI like this idea a lot.

Have you got any insight in to where you think their earnings may land going forward and what specifically this years c50% increase in EBIT was attributable?

I'm worked my way through their most recent Q and K but their English disclosures are obviously limited/not recent enough to pick up the most recent 2 Q which seems to be where the real magic has happened.

Initially, respirators seemed like the intuitive answer but the most recent Q I can see seems to pretty much balance out a slowing in some devices/segments against an increase in others - like resp. for example.

A lot of the operating margins rocket ship is a scale effect of increased revenues - but where from and is this at least somewhat sustainable in your opinion?

Thanks again for the write up. I very much value your commentary.

Thanks for commenting.

DeleteI have no clue where earnings are heading in the future.

The real magic happened in q4. That isn't really surprising, because sales usually peak at the 4th quarter.

I agree the business is starting to scale. The vast support army is finally paying off.

As far as I am aware, fukuda does not produce respirators, but sells a third party product.

All segments contributed to sales. But certainly, the patient monitoring system contributed most (percent wise).

I am positive for fukuda in the coming years. This stock could double, while business is stagnant and it would still be dirt cheap.

I just realised you did another profile on this business. Thanks for repeating your points. I'll keep coming back to your blog. Are you on Twitter? Wil

ReplyDeleteInteresting post. I would have thought the medical device market would be more global. What is to stop a producer from another country from entering the Japanese market and producing the same devices? Furthermore is there a reason Fukuda is limited to Japan and it hasn't tried to sell its devices abroad?

ReplyDeleteI would say regulation and yearly medical fee revisions by the state deter foreign entrance.

DeleteAlso Fukuda's strong hold is its support/ service. Not easily copied and transferable to other countries.

Thanks for the insightful write-up. Years ago I worked for a clinical software co which counted FD as a partner/customer - they sold our (niche) software with some of their devices in Japan. From that experience, including a visit to customers in Japan, my impression was that they hold a strong market position which is based in no small part due to the strength of their support team, including unparalleled "white glove" treatment, entrenching them with their customers and being a key reason why it is very difficult for outsiders to take market share in Japan.

ReplyDeleteWhat do you ascribe as the key reasons for the share price dropping following what would seem to be very strong results released at the end of Oct? Do you see any catalysts on the horizon for the share price to appreciate (other than continued growth in sales and FCF)? My 10,000 foot view would be for upcoming results to continue to demonstrate growth given the strength of their product line in monitoring - an area of particular need during the last two years of Covid. Thanks again for the write-up.

Thanks for the insightful comment! Not happening too often on my blog! Readers usually only consume and don't contribute.

DeleteAgree 100% with your comment.

Well, to be honest I do not see any catalyst for unlocking value in the near future. Fukuda- San is not too promotional stock price wise to put it mildly. Was demonstrated again with opting for listing on the new standard index instead of prime with the TSE.

I know about an activist that was being involved (AVI). I think they sold out of their position after Fukuda- San not answering one letter.

We have to be contented with improving operational metrics and (hopefully) increased dividends.

Interesting re lack of interest in IR / promotion efforts. Let's see what happens over coming quarters. Thanks again for the write-up.

ReplyDelete